The Best Strategies For Using Trading Options To Leverage Underlying Stock Price

Getting into the stock market can feel overwhelming at first, like everyone else speaks a language you haven’t learned yet. It’s no wonder many people stay away, even though access to trading is easier than ever.

Trading used to feel out of reach for the average person—slow, expensive, and wrapped in financial jargon. But with digital platforms, automatic execution, and real-time market data now available to anyone, the doors are open wider than ever.

Whether you’re using an app on your phone or exploring trading communities like Sniper Trades, access has improved dramatically. Fees are lower, information is more transparent, and it’s easier to get started—if you know where to look and what strategies to use.

This access doesn’t guarantee success, though. It only means more people can participate, which is great, but it also means you need a sharper edge to stand out. Knowing how and when to use strategies like options trading can help you find that edge.

In other words, these are good times for anyone with trading aspirations. People who’d have previously never gotten a fair shake have the opportunity to grow their wealth and solidify their futures.

We should point out that trading and investing haven’t suddenly gotten easier. The complexities still exist. Rather, you now have more avenues to learn and get involved–but learning and getting involved remain filled with challenges.

After all, the stock market isn’t cut and dry. You don’t simply hand over some money and expect it to pay out at a later date. There are layers–and as you peel back those layers, you create more puzzles that require more pieces.

This preamble brings us to derivative trading–a potentially critical component of your budding portfolio. Specifically, the above paragraphs lead into the options trading tips we’ll provide in this article.

What Is Options Trading And Why Could It Be An Ideal Strategy For You?

This advice will be primarily for people dipping their toes into the options trading waters. Thus, it’s catered to beginners and novices (not necessarily investment beginners, but those just getting their feet wet with options).

Nonetheless, it always helps more seasoned investors to brush up on their core fundamentals to remain sharp.

So–we’ll start by breaking down the basics of options trading before getting into our suggestions. Those with a fundamental grasp of options can skip to our option trading best strategy list below.

Without further adieu, let’s proceed:

An option is a speculative investment–or a bet–on whether an asset’s price will be lower or higher on a specific future date. These tradable contracts don’t require anyone to purchase the given asset.

We’ll use Nifty 50 options as an example. Nifty 50 is the benchmark stock index that functions as a stand-in for India’s entire stock market. The available options allow investors to speculate on the index’s future direction.

Below, we’ll delve into some key terms you’ll need to know before following our options trading tips:

Derivative

An option’s value is derived from other assets. With stock options, the option contract’s value hinges on the stock price in question.

Call And Put Options

Call options enable investors to purchase a security at a set price by a specific date. Put options are the other end of the deal, allowing investors to sell a security at a given price and date.

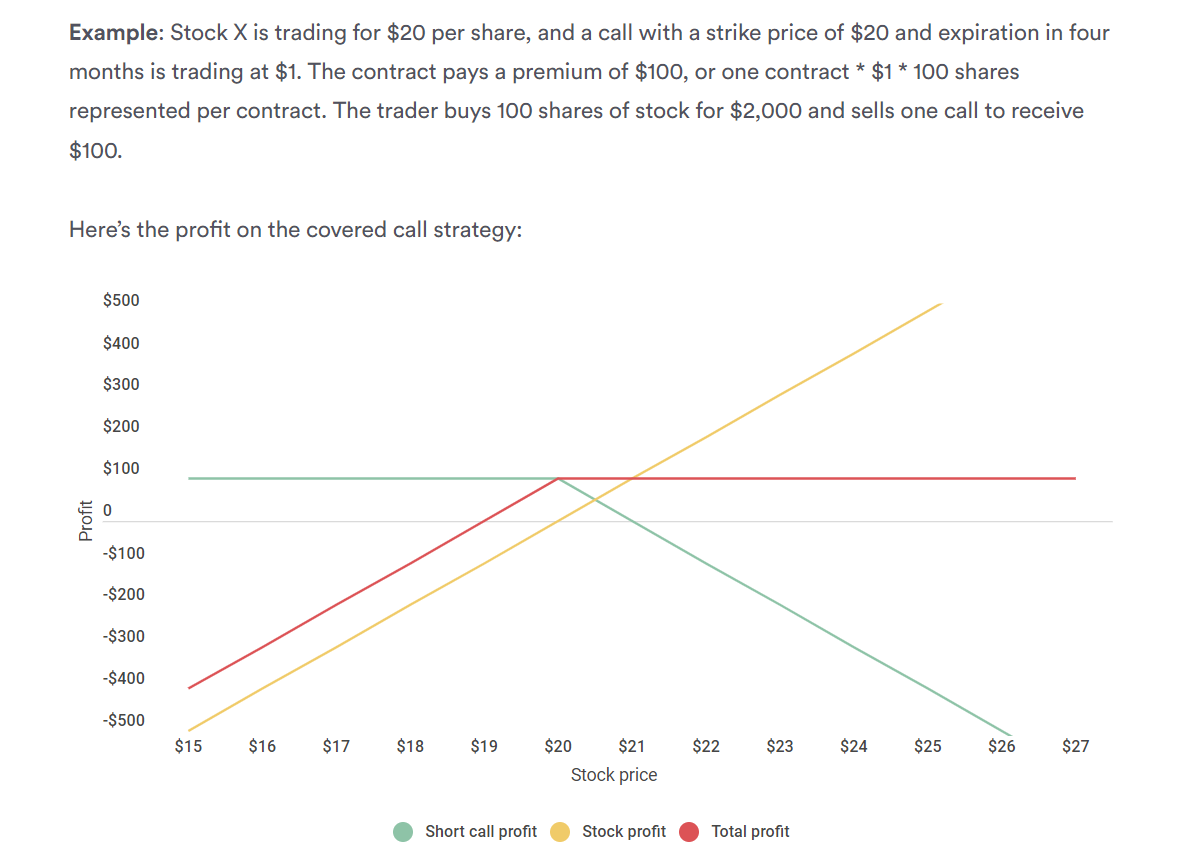

Sample Graph:

The Strike Price And Expiration Date

The strike price is the set price you agree to when calling or putting. When trading, you have until the contract’s agreed-upon expiration date to exercise an option at the strike price.

Premium

The purchasing price of an option is the premium. It’s derived by weighing the price and values of the underlying security.

Intrinsic And Extrinsic Values

Intrinsic value is the difference between the underlying asset’s strike price and current price in an option contract. Alternatively, extrinsic value involves factors that affect the premium but go beyond the intrinsic value’s scope (e.g., the length of time that the option is good).

In-The-Money And Out-The Money

These terms are relatively self-explanatory. In-the-money means a security is profitable, and out-the-money means unprofitable. The applicable term will depend on the security’s price and the remaining time before expiration.

Underlying Stock

With stock options, the underlying asset is the actual stock.

Say you have a stock option to buy 150 shares of Company X at 150$. In this instance, the underlying asset is Company X’s stock.

Underlying assets (or underlying stocks) help calculate an option’s value until expiration.

Why Should You Start (Or Continue) Trading Options?

If you’ve been trading and not seeing the results you want, you’re not alone. Everyone starts somewhere, and options trading offers tools that might better fit your goals and risk tolerance.

Plus, you’ve come to the right place to hone your skills.

Are you having doubts about whether options trading is for you? Let us quell those concerns with reasons to stick with options and develop your knowledge base.

Options Are Cost-Efficient

One of the more attractive features of options is their leveraging power. Investors can procure an options position that resembles a stock position while saving money.

Say you purchase 200 shares of a stock worth $80.

You’d have to pay $16,000–a lot of money for vast portions of the population.

Conversely, purchasing two $20 calls (at 100 shares per contract) would yield a $4,000 outlay. The calculation is 2 contracts x 100 shares/contract x $20 market price. This way, you’d save $12,000 compared to buying the stock itself.

Note that you’d need to invest in a strategically sound option to mirror the stock price–but following our options trading tips will help you do just that.

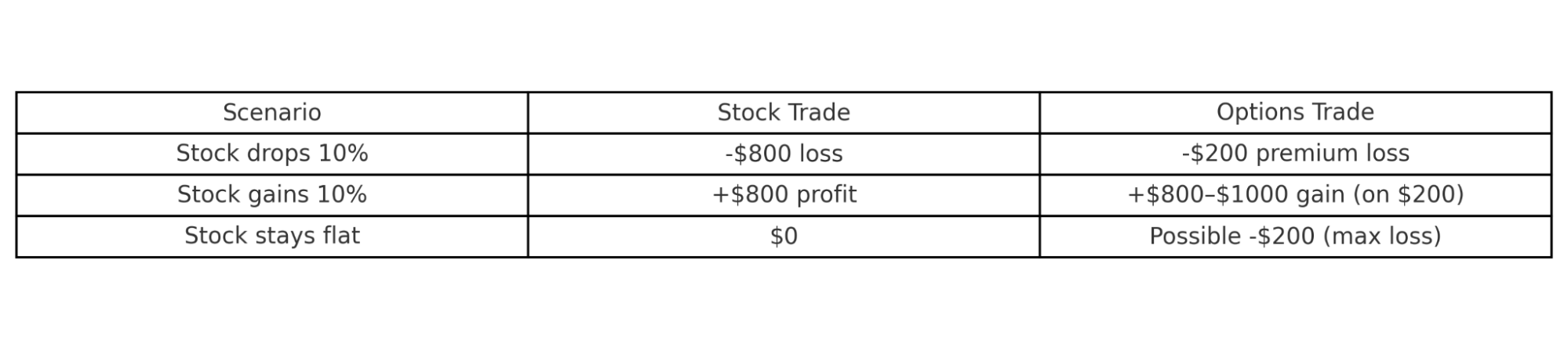

Here’s a quick example: imagine you buy a call option on XYZ stock with a strike price of $50, paying a $2 premium. If the stock rises to $60 before the expiration date, your profit is $8 per share (the $10 increase minus the $2 premium). But if the stock stays below $50, you lose the $2 premium, and that’s it. This defined-risk setup is what makes options so appealing to new traders.

Options Can Be Risk Averse Compared To Conventional Stock Trading

Buying options isn’t always risk averse compared to owning equities. However, following the option trading best strategy tips below will make it less risky.

Options don’t require as much financial commitment as equities. They’re also somewhat impervious to the impacts of gap openings (which can be catastrophic).

With options, you have a more dependable type of hedge. Thus, they can be a more risk-averse approach than stocks.

Stocks often have a stop-loss order applied to protect their position to prevent losses below a specified price. This gets complicated and risky because stop orders occur when the stock trades below or at the order’s predetermined limit.

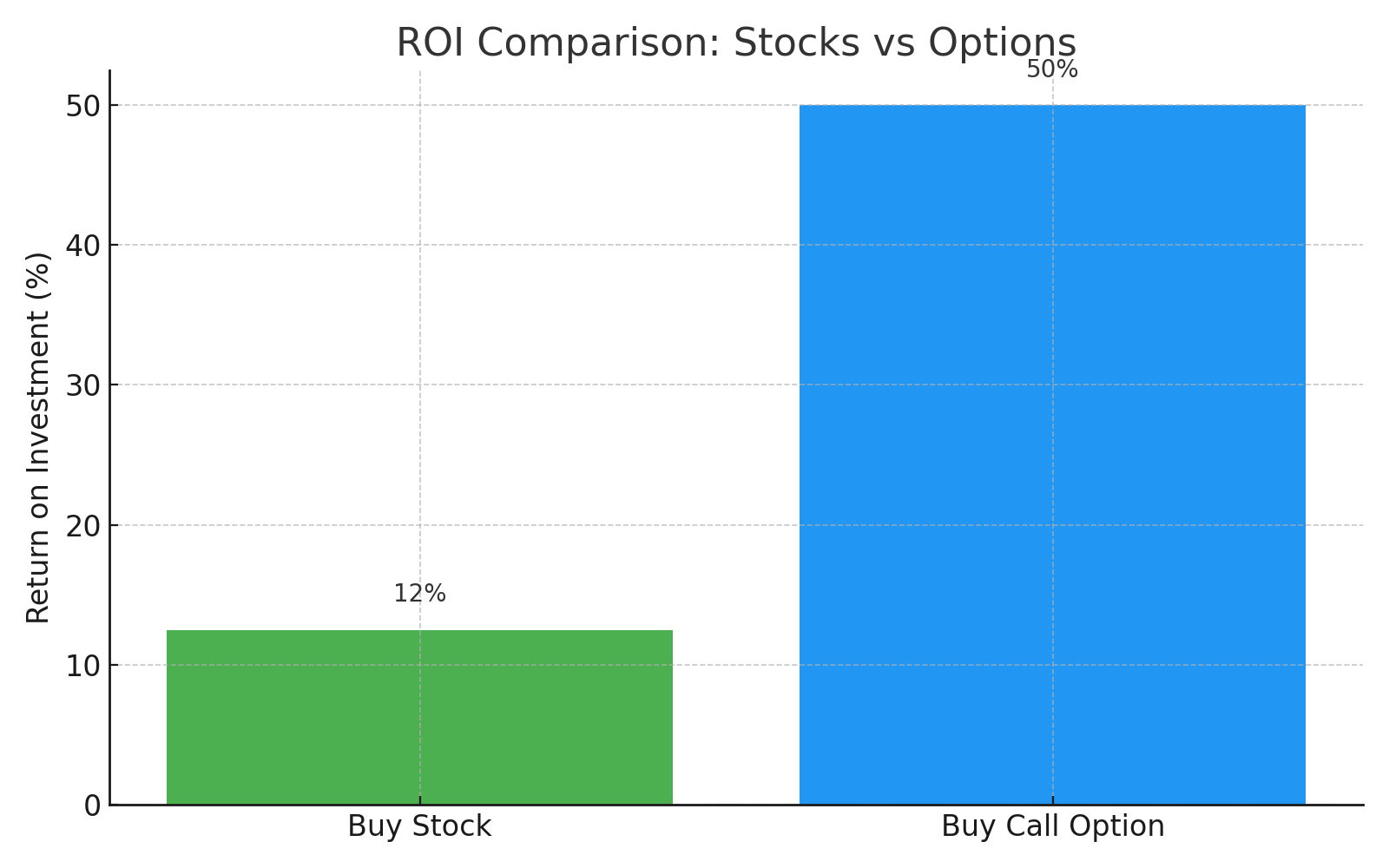

Options Offer Better Potential Returns

Fine-tuning your options trading strategy (which you can do by following our insightful options trading tips) offers superior returns to conventional stocks. The math is straightforward. You’re investing less while making the same profit, meaning you receive a higher percentage return.

Options don’t just reduce the cost of entry – they give you more ways to shape a trade around your outlook. Whether you’re expecting volatility, stagnation, or slow growth, there’s likely an options strategy that fits. That flexibility makes them a useful tool, especially when the market isn’t giving you clear signals.

Options Are a More Strategic and Versatile Trading Approach

Options give you the flexibility to mimic other positions, like stock ownership or short selling, without needing to actually own or borrow the underlying shares. Synthetic positions, for example, let investors replicate the payoff of holding stock while using less capital. And while many brokers restrict short selling due to high risk and margin requirements, most will allow traders to buy puts. A put gives you the right to sell a stock at a set price, offering a way to profit from a decline without taking on the full risk of a short.

Beyond direction, options let you trade based on time and volatility. Most stocks move within a range, and some barely move at all, especially in sideways markets. Options let you profit even when a stock goes nowhere, thanks to strategies that take advantage of time decay and implied volatility. This added dimension makes them especially valuable when the broader market feels flat or indecisive.

Quick Tips for Beginner Options Traders

- Start with simple strategies like covered calls or long calls before trying advanced ones.

- Always define your max risk before entering a trade—never guess.

- Watch time decay—options lose value fast as expiration approaches.

- Use volatility to your advantage: sell options when it’s high, buy when it’s low.

- Track every trade. Journal what worked, what didn’t, and why.

- Pick one stock you follow, and practice building a simple call or put option trade using a free options calculator like the one on CBOE or Investopedia.

Want to practice these strategies in real time with a team backing you up? Sniper Trades gives you access to expert-led breakdowns and live chat with seasoned traders. Try it free for 7 days and see how pros approach each trade.

Option Trading Best Strategy Tips

Here’s the meat of our article–our options trading tips. Follow these insights and perspectives, and you’ll be well on your way to bolstering your portfolio.

View Options As Extensions Of Stocks

All traders sometimes face confusion when deciding to sell or hold onto a security. It goes part and parcel with trading–not that this commonality makes this scenario any less daunting.

Fortunately, options can be your trading floatation device in otherwise murky waters. The flexibility offered by options can keep you afloat–if not thriving–during trade snafus.

Consider these factors:

When you trade stocks exclusively, you’re limited to buying stocks to initiate bullish exposure.

You’re also restricted to bearish exposure when shorting stocks.

Success in these areas requires your accurate guess of a stock’s direction. You wouldn’t be alone if all this “guessing” made you squeamish.

In this context, options live up to their name. They provide investors and traders with (you guessed it) options.

Options empower you to bet short or long with far less capital expenditure and risk exposure.

Does this mean options should be your only trading tool? Probably not.

Diversity is the spice of life, and keeping well-rounded in your approach is always a best practice. Still, options can be a highly lucrative stock trading extension–and tool–that can bring your investment ideas into a profitable reality.

Use Options To Stack The Deck In Your Favor

Stock trading is mostly binary—you profit if it goes up (long) or down (short), and you’re right or wrong 50% of the time. Options give you more flexibility. Depending on how you structure the trade, you can make money if the stock rises, stays flat, or even drops slightly. That flexibility is what makes options so powerful.

More importantly, options let you benefit when other traders overreact. Fear-based selloffs or hype-driven spikes often cause temporary mispricings. A well-timed options trade can take advantage of that short-term volatility without exposing you to the same level of risk. You don’t have to fight the market—you just have to be ready when it overcorrects.

That’s how experienced traders “stack the deck.” They look for moments when emotion drives price action, then position themselves with defined risk and a higher probability of profit. If you can stay calm while others panic, options give you the tools to profit from that imbalance.

Use Options To Enhance Your Portfolio

Adding more risks isn’t always the best way to improve your portfolio. To that point, you’ll often find that using options to cut down on risk while adding income is the special sauce your portfolio needs.

Reducing risks isn’t typically possible when only trading stocks.

That said, your portfolio might not need to be improved and may not need to reduce risk. Still, remaining vigilant and attentive to scenarios that could bolster your portfolio is how to trade successfully in the long run.

Seeking every opportunity to make strategically-inclined bets will put you on a promising path. This statement holds true whether you’re focused on income, steady growth, or even short-term profits.

A successfully expanded portfolio is the product of consistency. As an effective options trader, the good times will keep rolling even when your portfolio is under pressure, never mind when it’s expanding.

Also, maintaining a clear head by remaining informed on when to use the appropriate tools is crucial, no matter the circumstances.

The kicker is that building a valuable toolkit is easier said than done. Yet, when you peel back the layers, you’ll find that options trading isn’t as complicated as it initially seems. Beginners can bone up and make intelligent moves quicker than they’d imagine.

Successful Options Trading Is a Product of Patience

Think of options trading like a full baseball season. Even the best teams lose around 60 games—they don’t panic after one loss because they focus on long-term consistency. You should approach trading the same way.

Not every trade will be a winner, even if your strategy is solid. But if you’re patient and wait for setups that align with your edge, you’ll rack up more small and large wins over time. Impulsive trades, on the other hand, usually lead to avoidable losses.

Patience isn’t just about waiting. It’s about being deliberate—only swinging when the pitch is right. That mindset will protect your capital and keep your confidence intact, even when trades don’t go your way.

Always Have Your Exit Strategy In Mind

When the term “exit” is applied to trading and investing, it has negative connotations. It seems like it only applies to escaping from a bad situation.

While it’s wise to have an exit strategy if things go south, you also want to have a way out when things go well.

Whether an exit is uphill or downhill, pre-selection is a must.

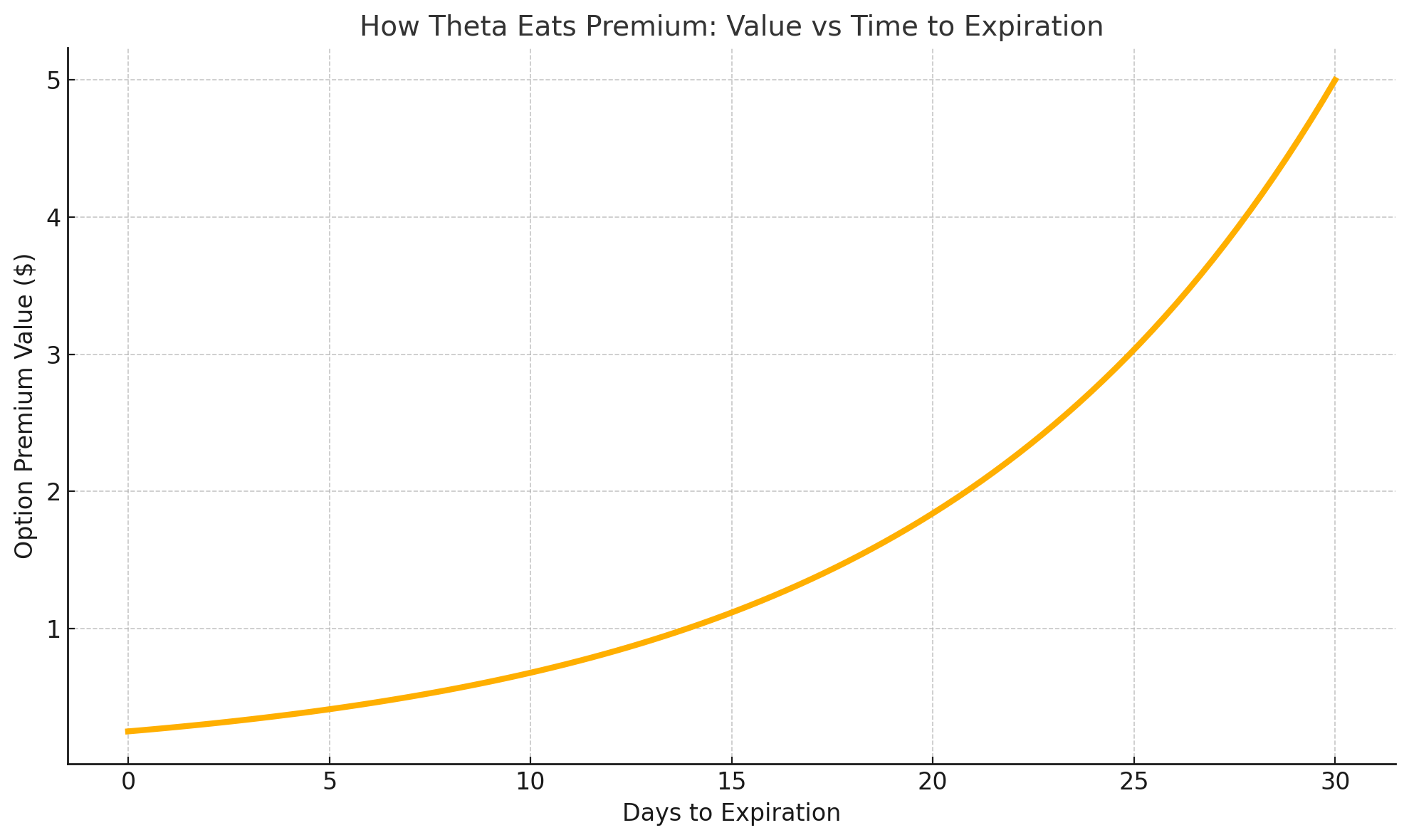

Note that exiting from stock options involves more than price targets. You should also apply a time frame since the expiration accelerates as it nears.

Say you’ve taken a long position or a put option, and the desired result hasn’t happened within your projected timeframe. In this instance, it’s time to exit and move on to another opportunity.

Despite the losing scenario in the above example, time decay works in your favor when selling without owning an option. When time decay decreases an option’s price, you can sell and hold onto the premium you receive.

There can be a downside to time decay. You can face substantial risk if the trade goes belly up.

Regardless, a plan to get out of every transaction will limit risks and losses. Don’t allow thirst for more profits to halt a beneficial trade. Nor should you stick with losers in hopes that it turns around.

A fledgling investment could turn around after your exit. Don’t let concerns about this unlikely outcome stop you from following your exit strategy. While there are occasions where profits are left on the table, sticking with a loser isn’t a high-percentage play.

Most often, you’ll find that following your exit strategy saves you from more significant losses. As such, it’s the behavior most conducive to lasting success as an options trader.

Trading Isn’t A Tool For Recovering Losses

All the practical trading know-how in the world can be powerless in the gaping shadow of your emotions.

For instance, you could face all sorts of emotionally driven temptations when a trade doesn’t go your way. Then, suddenly, your personal trading rules might fly out the window.

In times of distress, you may find yourself trading the options you began with. From there, you could want to purchase more shares to lower the transaction’s net cost base. All we can say is to proceed with caution in these scenarios.

A trader’s success doesn’t need to depend on the stock market offering value. Since options are derivatives of stocks, the price moves differently than the underlying stock and has its own traits.

Yes–you can lower the entire position’s cost-per-contract base by doubling down when a deal goes wrong. Generally, though, such a move will drastically increase risk.

The reality is you’ll make moves that won’t work out. Don’t use this as a reason to go against the principles of strategic trading. Instead, take a deep breath, lick your proverbial wounds, cut your losses, close trades, and examine other potential options.

Trading options requires that you fully comprehend their dark side. Sure–you can enjoy high leverage for comparatively minimal capital. Still, it’ll only work for you in the long run if you know when to admit defeat instead of creating an even bigger catastrophe by holding on.

One Last Option Trading Best Strategy For Beginners And Veterans Alike: Sign Up With Sniper Trades.

Are you seeking resources to fine-tune your trading skill set? Do you want a leg up to give you an advantage as a retail trader, options trader, or any other type of trader?

If so, signing up with Sniper Trades could be a difference-making ingredient in your recipe for trading success.

We run the fastest-growing Discord group for traders, providing educational content, such as:

- Options flow interpretation.

- Technical and chart analysis.

- Macroeconomic interpretation.

- Account management.

- Trader psychology.

- Top strategies for getting in and out of positions.

You don’t have to commit upfront. Try out our premium features with a seven-day trial and explore the tools, analysis, and community we’ve built. During the trial, you’ll have view-only access so you can see what we offer without pressure.

Common Rookie Mistakes in Options Trading

One of the biggest mistakes new traders make is buying cheap, far-out-of-the-money options because they’re low-cost. While tempting, these options have a much lower chance of expiring profitably and often expire worthless. It’s better to focus on trades with a realistic probability of success—even if they cost more upfront.

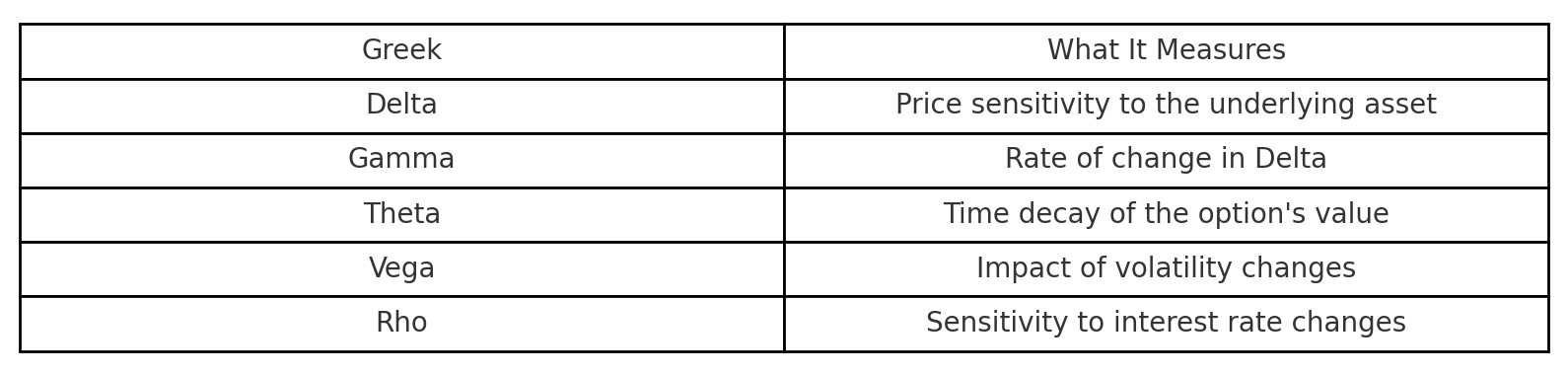

Another common error is ignoring implied volatility. High IV might make an option look expensive, but that inflated value can collapse fast, turning a good idea into a losing trade. Always check the option Greeks, especially delta and theta, to understand how the position will behave over time.

Lastly, many beginners hold losing positions too long, hoping they’ll turn around. Options are time-sensitive. If the trade isn’t working and time is running out, cut the loss and move on. Protecting your capital matters more than chasing every win.

When Options Might Not Be the Best Fit

If you’re brand new to investing or struggle with emotional decision-making under pressure, options might overwhelm you. They’re not passive income tools—they require active engagement, research, and constant learning. That’s why having a strong foundation first is essential.

Want to learn more about Sniper Trades and what we offer our clients? Contact us today with any questions, and we’ll be more than happy to answer.